Fintech’s hype and perils elevate academic research interest to new heights

An investigation into academic papers reveals surging appetite among academics for topics such as Cryptocurrency, ICO and Blockchain, at a time when fintech fights an increasingly challenging war against regulatory oversight and tougher market conditions

Exponential growth in price among leading cryptocurrencies in the past year that bumped up appetite among investors was met with similar avidity for new supply of early-stage academic papers within the fintech space, a new analysis finds.

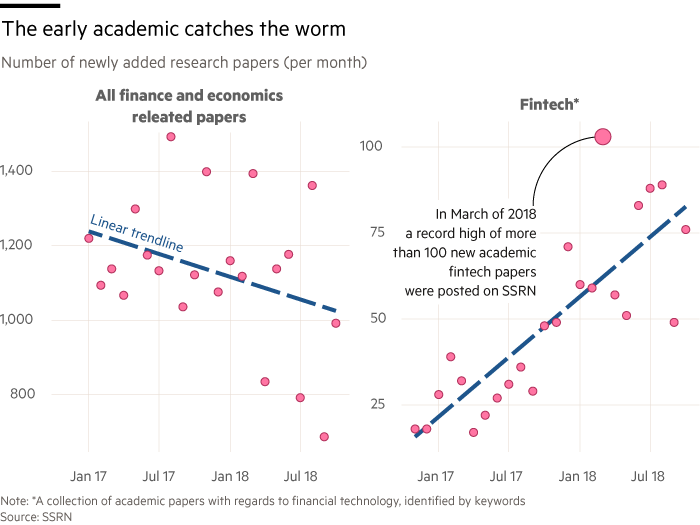

Data shows that the monthly average for newly submitted fintech papers to SSRN, an online academic network for early stage academic research, grew by 100 per cent from 2017 to 2018. For comparison, the same period saw a shallow decline of 10 per cent in the numbers of new finance and economics related submissions.

Metadata for 1,188 fintech research papers uploaded within the past several years, was provided by the network. The Social Science Research Network which was bought by the Dutch information and analytics company Elsevier in 2016, is one of the leading platforms in aiding academics to disseminate findings early, sometimes years ahead of time until formal publications in scientific journals. It containing research from various domains, many without a formal accreditation of a scholarly peer review. Findings suggests that since 2016 the rate of new content relating to cryptocurrency, ICO and Bitcoin climbed at an unprecedented rate.

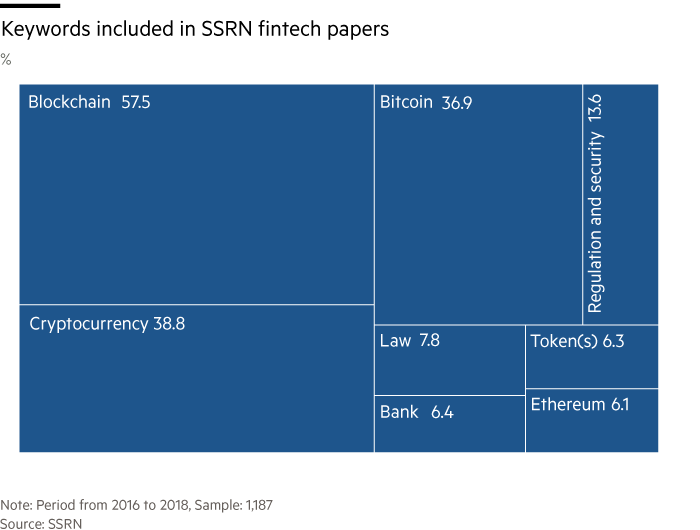

Nearly three fifth of papers or 57.5 per cent of fintech paper discussed Blockchain technology. 38.8 per cent discussed topics connected to cryptocurrencies. Specific crypto valutas such as Bitcoin were included 36.9 per cent of the time while Law and Bank(ing) accounted for 7.8 per cent and 6.4 per cent of the volume, respectively.

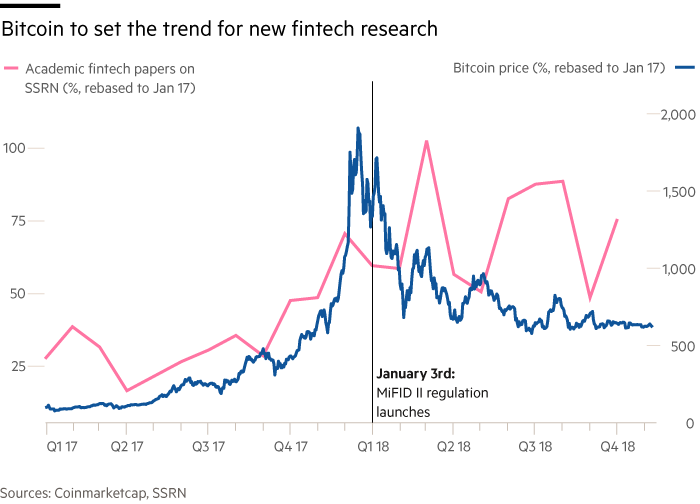

The increase in new research within these areas coincided with the price hysteria among major cryptocurrencies. Bitcoin’s exponential price surge last year, hitting a peak close to $20,000 in late 2017 was emulated by newly added fintech papers over the same time period. Though, after the point when Bitcoin slumped around the same time last year, supply of new research held up at a monthly average of 71.5 for 2018.

Aside of surging prices in the cryto market, another factor may have played a role, according to SSRN’s own analysis. The much-anticipated implementation of the MiFID II regulations - an EEA wide policy that promises to provide harmonised regulation for investment services, and which was launched in January – may have contributed to the heightened interest among academics.

The update to the original “Markets in Financial Instruments Directive” encouraged much debate. Critics argue that IT departments within investment banks may be ill-equipped to deal with the surge in report and record-keeping, which the new directive demands. This may have spurred academic communities to step up efforts to investigate regulations and perhaps shortcomings. Papers that mention bitcoin include the keyword regulation nearly one in 10 cases, or 8.7 per cent of the time.

Since approved by the Financial Markets Authority, cryptocurrencies exchanges such as Blocktrade.com aim to benefit from being fully MiFID II compliant by being recognised as a new asset class by regulators across Europe.

Daniel Ferreira, professor at the Finance London School of Economics explains that demand for fintech research is very much supply driven: “Once a few researchers get interested in a topic, they become not only producers but also consumers of the research”.

Ferreira adds that the recent drop in prices of major currencies such as Bitcoin would not inhibit research on the topics prospectively. Instead, he insists the contrary to be true: “It may actually trigger more research into the causes of such failures”.

How issues with cryptocurrencies animated research

The shortcomings of cryptocurrencies and impact on societies is heatedly discussed in new papers added since the Bitcoin shock, the analysis shows.

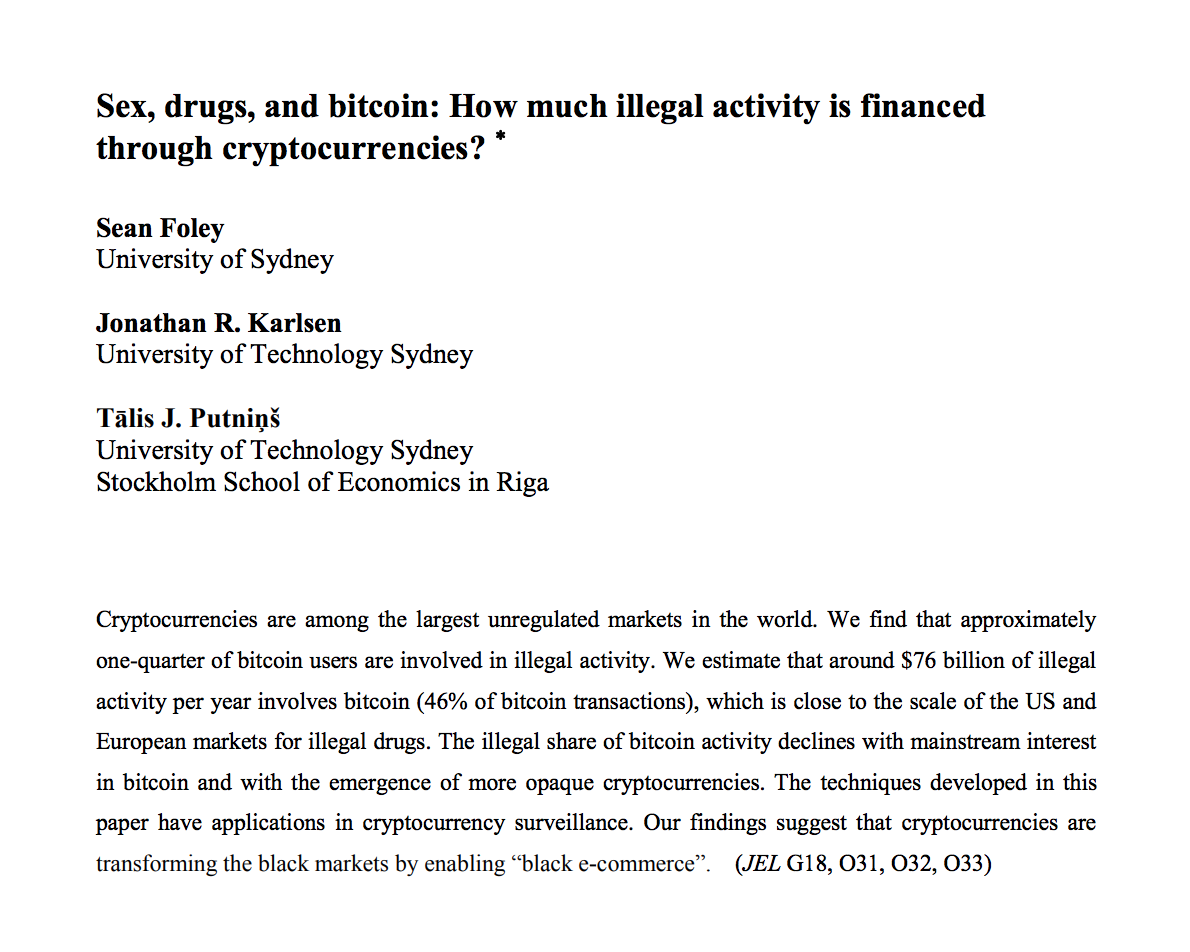

In January - discussing applications on how to surveil and regulate the cryptocurrency market – the paper with the provocative title “Sex, Drugs, and Bitcoin: How much illegal activity is financed through cryptocurrencies?” was uploaded and became instantly very popular. To date, it received nearly 6,000 downloads, around 23,000 clicks and ranks among the 1,008 most frequently accessed papers within a pool of more than 800,000 abstracts held by the platform.

The example shows how important timing is. The research was accessible by the fintech research community and beyond at the very point when the new domain was deeply challenged, at a time when bitcoin imploded. The shortcomings of market regulations and oversight were most feverishly discussed within politics and businesses. The research added itself timely to the discussion.

The response, impact and recognition of it was made possible by sharing it at an early stage, include getting feedback from peers that ultimately improves the quality of the final research paper explains co-author of the piece, Talis J. Putnins, a professor at the finance discipline group at UTS Business School in Sydney: “It also allowed others to build on that research sooner rather than waiting sometimes years, which pushes the field ahead at a faster rate, especially considering the peer review process at journals can take quite some time”, he says.

SSRN has its foundation in the early nineties. It grew slowly for three decades and only recently became more popular outside tight-knit academic circles.

Gregg Gordon, Managing Director of SSRN says that among other platforms, SSRN emerged as early science network with the largest “breath” of research. It would cover variety of fields with more depth than others. From the very start, SSRN was active in finance and economics, he says.

How fast-paced domains such as Fintech can benefit from early-stage online research networks

Dubbed recently in his podcast as “the greatest website on the Internet”, Canadian journalist Malcom Gladwell picked up on SSRN and helped to introduce it to people beyond academia.

Mr. Ferreira says that among students, the demand to learn more about quickly emerging topics such as Blockchain, cryptocurrencies and ICOs is also growing. On the contrary, there would be no clear steer from above, either from Universities and its departments, nor from the industry. “I think the main appeal of such topics is their controversial nature”.

Additional interest boosted the numbers of papers read and downloaded. Initial Coin Offering (ICO), received over half a million paper downloads in the past two years, and quickly grew to be one of the hottest new area on the platform, according to a statement by SSRN.

As topics like cryptocurrencies become more popular among students, Universities slowly follow up by implementing courses to stay ahead of competition. Nowadays, 42 per cent of the World’s top 50 universities offer at least one course in crypto technology or Blockchain, according to cryptocurrency blog Coinbase.

Another reason why platforms such as SSRN can do many academics in some instances a favour is that many of the new papers would not even make it thought the peer review process, in the first place. Generally, nearly half don’t, explains Mr. Gordon. This means that the conventional academic publishing process veils much valuable ideas that may not be fully reasoned just yet. Destined to never to meet the eyes of fellow academics that could benefit from synergy effects, the alternative offers sharing papers early and speedily.

Continental split: US vs Europe

The data offered by SSRN also revealed specific regional differences. For instance, much of the research that originated from Chinese academics focused on how to hamper fintech. Given that ICO is officially banned in the country and the strong national oversight by the Chinese communist party, the findings are not surprising.

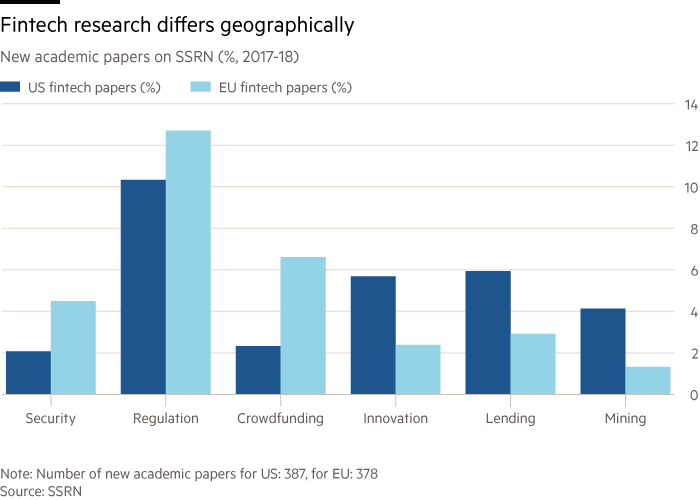

What is surprising is the volume of various tags that show signs of a division between US and EU academics and their approach towards fintech.

US academics include keywords describing ways to leverage entrepreneurial market opportunities more frequently, while fewer of those papers give the impression to keenly investigate fintech’s perils.

As a result, keywords such as “Innovation”, “Lending” and “Mining” are more frequently in use by US academics than among their European peers.

In contrast, researchers from Europe are found to be more concerned with regulating the market and raising capital with cryptocurrencies. Keywords such as “Security”, “Regulation” and “Crowdfunding” are pronounced.

Late last year, Elsevier announced to start another early-stage research network committed the engineering domain. Similar to the other versions sharing of preprints, non-peer-reviewed preliminary results write-ups, working papers and data, prior to publication is offered, according to a press release.

Despite its commitment to speed up academic publishing, Elsevier received criticism concerning its pricing policies and also for overly aggressive copyright enforcement, writes George H. Pike in a feature on the firm’s decision to purchase SSRN. Elsevier has been seen by its critics as an “enemy of open access”, that may affect the pricing model for SSRN in the future.

Analysis and reporting by @BenHeubl

Leave a Comment